The Secretary amends the restrictions governing the money contingent repayment (ICR) and income-dependent repayment (IBR) plans and renames the types of repayment strategies obtainable from the Division's Direct Loan Program. These rules streamline and standardize the Direct Loan Software repayment regulations by categorizing current repayment strategies into a few sorts: (1) set payment repayment programs, which set up every month payment amounts determined by the scheduled repayment time period, loan personal debt, and curiosity level; (2) income-pushed repayment (IDR) plans, which create monthly payment amounts located in total or in part around the borrower's earnings and family dimensions; and (three) the alternative repayment approach, which we use with a situation-by-situation foundation every time a borrower has Remarkable circumstances or has failed to recertify the information required to calculate an IDR payment as outlined in § 685.221. We also make conforming edits for the FFEL software in § 682.215.

Numerous commenters strongly supported the proposed REPAYE provision that could lessen the level of discretionary income paid out towards pupil loans to 5 p.c for a borrower's remarkable loans taken out for undergraduate review.

We disagree With all the commenter's framing on the Section's coverage. Forbearances and deferments are statutory Positive aspects presented to borrowers every time they fulfill certain criteria, for example deferments for borrowers though They may be going through economic hardships or forbearances for students who are servicemembers who happen to be named up for armed forces duty. We have thoroughly reviewed all of the several forbearances and deferments available to borrowers and deliberately made a decision to only award credit history towards IDR forgiveness for people instances where the borrower would or would be very more likely to have a $0 payment or where There exists confusion about whether they should really pick out IDR or the opportunity to pause their payments.

Simply because we are structuring the catch-up period to use The existing IDR payment, we are excluding durations of in-faculty deferment from this provision. Borrowers may well commit a number of a long time in an in-school deferment, graduate, and then straight away go on to IDR employing their prior (or prior-prior) yr tax data, which would probably make them qualified for a $0 payment when they were not Doing work complete-time when in class.

Commenters elevated a series of specific issues with regard to the legality of every major proposed adjust inside the IDR NPRM, Particularly escalating the money defense threshold to 225 percent of FPL, cutting down payments to five percent of discretionary money on undergraduate loans, the cure of unpaid month-to-month curiosity, counting intervals of deferment and forbearance toward forgiveness, and giving a speedier path to forgiveness for borrowers with decreased original principal balances. Dialogue:

Various commenters prompt that the shortened forgiveness threshold ought to be indexed to inflation. A single commenter asked for which the Office publish once-a-year inflation changes. Another commenter indicated that if we index the amount to inflation, we should demonstrate how inflation adjustments would implement to borrowers who ended up in school versus in repayment. Yet another commenter disagreed and felt the Office should not apply inflation adjustments on the forgiveness amount since the Department has presently connected early loan forgiveness to loan boundaries and loan boundaries will not improve that often and the value erodes.

We don't believe this treatment method of compelled collections amounts as akin to lump sum payments would set borrowers in default in a greater situation than those who are in repayment or deliver far better procedure to someone who voluntarily can make a lump sum payment than someone in this case who may have not picked to. For a person, the borrowers in default would nonetheless be experiencing the adverse penalties connected with default, which include unfavorable credit rating reporting. These quantities would also not be voluntarily collected. Someone that makes a lump sum payment in repayment is picking to take action. In these circumstances, a borrower is just not picking out the amount of money which is gathered and it is very most likely that they'd prefer to not make this kind of substantial payments all of sudden. Because the borrowers in default will not be managing the quantities gathered, they cannot ensure which the quantities collected wouldn't be in excessive of the amount at which they would end acquiring credit toward forgiveness.

Clarifying that borrowers pay back 5% of discretionary earnings toward loans received for his or her undergraduate research and 10% for all other loans, which includes Individuals once the tutorial amount is mysterious.

When we know that some mum or dad As well as borrowers could wrestle to repay their debts, mum or dad Furthermore loans and Direct Consolidation loans that repaid a mum or dad PLUS loan won't be eligible for REPAYE less than these closing laws. The HEA has long distinguished among guardian Additionally loans and loans built to college students. In fact, area 455(d)(one)(D) and (E) from the HEA prohibit the repayment of get more info dad or mum Furthermore loans via both ICR or IBR plans. Next alterations created towards the HEA by the upper Instruction Reconciliation Act of 2005, the Division decided that a Immediate Consolidation Loan that repaid a father or mother In addition loan initially disbursed on or after July 1, 2006, could be qualified for ICR.[46] The dedication was partly due to data restrictions that designed it tough to track the loans underlying a consolidation loan, together with recognition of The point that a Direct Consolidation Loan is a new loan. In granting usage of ICR, the Section balanced our goal of enabling the lowest-cash flow borrowers who took out loans for their dependents to have a route to very low or $0 payments without having producing Advantages so generous that the program would fail to acknowledge the foundational differences proven by Congress amongst a father or mother who borrows for just a pupil's schooling as well as a college student who borrows for their own individual education. The income-driven repayment programs supply a basic safety Internet for scholar borrowers by enabling them to repay their loans like a share in their earnings in excess of a variety of yrs. Lots of Parent Start Printed Web page 43836 In addition borrowers usually tend to have a transparent photo of no matter if their loan is economical if they borrow as they are more mature than scholar borrowers, on ordinary, as well as their extensive-expression earnings trajectory is both equally a lot more regarded as a consequence of amplified time from the labor pressure and much more likely to be steady when compared to a current graduate commencing their profession. Additional, for the reason that dad or mum As well as borrowers do circuitously get pleasure from the academic attainment in the diploma or credential realized, the father or mother PLUS loan will not aid investments that enhance the father or mother's own earnings.

Many commenters suggested that lump sum payments need to be counted as catch-up payments and handled precisely the same in both IDR and PSLF. Dialogue:

We also partly disagree With all the recommendation to not apply this curiosity gain for periods every time a borrower has no or low earnings or when they're in selected deferment and forbearance intervals. Over the latter position, the Division is not transforming the therapy of fascination when a borrower is over a deferment or forbearance. This aligns While using the commenter's request. Meaning that borrowers frequently will not likely see curiosity accumulate on their backed loans even though in deferment, when they'll see curiosity billed on unsubsidized or PLUS loans, which includes while within a deferment or forbearance.

We affirm our selection as outlined during the IDR NPRM [74] to decreased payments only on undergraduate loans to 5 per cent of discretionary income. The Section is dedicated to using actions for making student loans additional cost-effective for undergraduate borrowers, the people who are at the greatest threat of default and that are not applying the existing IDR programs at the exact same frequency as their peers who attended graduate college. In carrying out this goal, the Department looked for a means to offer increased parity in between the main advantages of IDR for a standard undergraduate borrower with a typical graduate borrower. Historically, graduate borrowers are already additional prone to use IDR than undergraduate borrowers, suggesting that the financial benefits provided to them below present IDR ideas assist in driving their enrollment in IDR. Accordingly, working with Advantages furnished to graduate borrowers as being a baseline is an inexpensive approach to seeking to get much more undergraduate borrowers to enroll in IDR in addition. As mentioned from the NPRM, the Division observed that at 5 per cent of discretionary income, a normal undergraduate borrower would see similar discounts as a typical graduate borrower. Thus, the approach taken while in the NPRM which ultimate rule presents higher parity and can assist the Division in its intention of obtaining additional undergraduate borrowers to make use of these plans, driving down delinquency and default. Our expertise with latest IDR courses signifies that graduate borrowers are previously prepared to enroll in IDR at large premiums even with payments set at ten percent payment of discretionary revenue.

This gain will give low-cash flow borrowers who act quickly in default a fast route back into very good standing without the need of exhausting possibly their rehabilitation or consolidation alternatives.

We thank the commenters for their favourable remarks and solutions for advancement concerning the appliance and computerized recertification processes. We recognize the commenters' concern about preserving the current method with the IDR application in position. Even so, we believe that the method we have formulated improves and streamlines our procedures for borrowers. We will proceed to hunt extra methods to boost procedures. In response to your commenters' issue about inherent problems non-submitting borrowers encounter with recertification, underneath § 685.

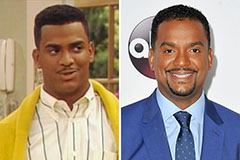

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now!